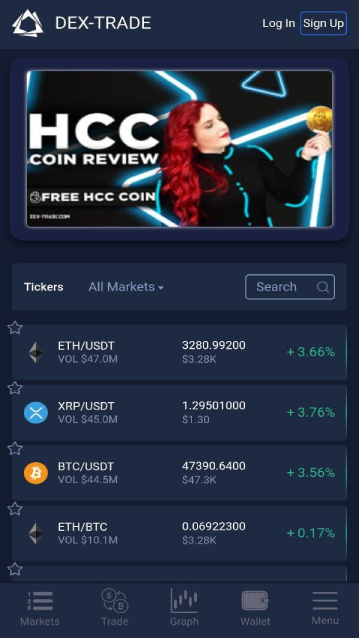

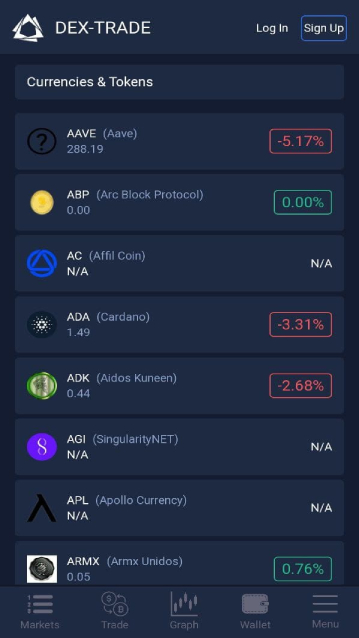

Dex Exchange APK is a comprehensive financial platform for most major cryptocurrencies like Bitcoin, Ethereum, Litecoin, etc.

Cryptocurrency trading platform with very low commissions.

The site offers the world's most liquid exchange and allows users to easily exchange one cryptocurrency for another or the world's major currencies. We also have a range of order types to help traders in any possible situation.

Safety is always our priority. Dex Exchange provides a secure, reliable, and stable environment for trading digital assets through a mobile application and web interface. We use the most advanced technologies to provide the best services for organizing business in this industry.

Dex Trade is confident that the trading of digital assets will increase the efficiency of financial transactions in the global economy. We focus all efforts on improving and expanding our customer service.

What is Dex Exchange APK for Android?

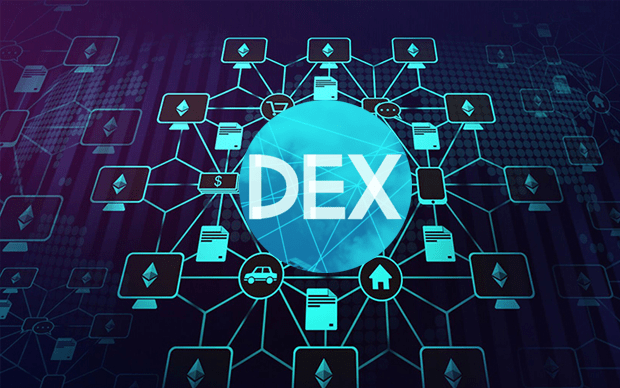

Dex Exchange is a peer-to-peer marketplace that allows users to trade non-custodial cryptocurrencies without the need for an intermediary to facilitate the transfer and custody of funds. DEXs replace intermediaries traditionally employed by banks, brokers, payment processors, or other organizations and facilitate asset transfers using blockchain-based smart contracts.

Compared to traditional financial transactions, which are conducted by intermediaries who are opaque and offer very limited insight into their operations, DEXs provide full transparency into the mechanisms that facilitate the movement and exchange of funds. Also, since user funds do not pass through a third-party cryptocurrency wallet during trading, DEX can reduce counterparty risk and reduce the risk of systemic concentration in the cryptocurrency ecosystem.

DEX is the cornerstone of decentralized finance (DeFi), serving as a key “money lego” that can build more complex financial products through permissionless integration.

How does the Dex Exchange APK work?

There are several DEX designs, each offering different advantages and trade-offs in terms of feature set, scalability, and decentralization. The two most common types are order book DX and Automated Market Makers (AMM). DEX aggregators are also a broad category that analyzes multiple DEXs on-chain to find the best price or lowest gas price for a user's desired transaction.

One of the main advantages of Dex Exchange for Android is the high level of staking achieved through the use of blockchain technology and immutable smart contracts. While centralized exchanges (CEX) like Coinbase or Binance have a platform that facilitates trading using the exchange's internal matching engine, DEXs trade through smart contracts and on-chain transactions. Additionally, DEX allows users to maintain full custody of their funds through their self-hosted wallet while trading.

The users generally pay two types of fees – network fees and trading fees. Network fees refer to the gas costs of on-chain transactions, while trading fees are charged by the protocol, its liquidity providers, token holders, or a combination of these entities specified in the protocol design.

The vision behind many DX is an end-to-end on-chain infrastructure that is permissionless, has no central points of failure, and has decentralized ownership across a distributed community of stakeholders. This means that protocol governance rights are controlled by a decentralized autonomous organization (DAO) consisting of a community of stakeholders who vote on key protocol decisions.

However, maximizing protocol decentralization in a crowded DEX landscape is not an easy task, as the core development team behind a DEX is usually more concerned with distribution-critical protocol features than making informed decisions. However, many DEXs choose a distributed governance structure to increase censorship resistance and long-term resilience.

Order Book Decks

The order book – the real-time collection of open buy and sell orders in the market – is a fundamental pillar of electronic exchanges. The order book allows the exchange's internal system to match buy and sell orders.

Fully on-chain order book DEXs have historically lacked DeFi because they require all interactions within the order book to be posted to the blockchain. This requires higher throughput or significant compromises in network security and decentralization than most existing blockchains. As a result, early examples of order books on Ethereum had poor liquidity and user experience. However, these exchanges were an impressive demonstration of how it can facilitate trading using smart contracts.

By introducing scalability innovations such as Layer 2 networks such as Optimistic Rollup and ZK-Rollup, as well as high-throughput and application-specific blockchains, on-chain order book exchanges have become more viable and now attract significant amounts of trading activity. Additionally, hybrid order book designs are becoming increasingly popular, where order book management and matching processes occur off-chain, while trade settlement occurs on-chain.

Automated Market Maker (AMM)

DEX is most used by automated market makers because it enables instant liquidity, democratized access to liquidity provision, and, in most cases, permissionless market making for any token. An AMM is a money robot that is always ready to tell the price between two (or more) assets. Instead of an order book, AMM uses a liquidity pool against which users can exchange their tokens, with prices determined algorithmically based on the proportion of tokens in the pool.

AMM allows immediate access to liquidity in liquid markets, as users can place bids at any time. With an order book, an interested buyer must wait for their order to match a seller's order - even if the buyer places an order near the current price at the top of the order book, the order will never be executed. can't happen

In the case of AMM, the exchange rate is set by a smart contract. Users can access instant liquidity, while liquidity providers (investors in AMM's liquidity pool) can earn passive income through trading fees. This combination of instant liquidity and democratized access to liquidity provision has triggered an explosion of new tokens through AMM and unlocked new designs focused on different use cases: b. Stablecoin Swap. If you want more detailed information about AMM, check out this post which explains how AMM works.

Dex Exchange Risks and Considerations

DEXs democratize access to trading and liquidity provision through strong enforcement guarantees, increased transparency, and permissionless access:

Smart Contract Risks – Blockchain is considered very secure for conducting financial transactions. However, the code quality of a smart contract depends on the skill level and experience of the team developing it. Bugs, hacks, vulnerabilities, and exploits can occur in smart contracts, causing users to lose funds. Developers can mitigate this risk through security audits, peer-reviewed code, and solid testing methods, but due diligence is always required.

Liquidity Risk – While DEX is becoming more popular, liquidity conditions in some markets are poor, leading to greater slippage and user experience. Because of the way liquidity network effects work (higher liquidity attracts more liquidity, lower liquidity attracts lower liquidity), a significant portion of trading activity still takes place on centralized exchanges, often in DEX trading pairs, which results in lower liquidity.

Front-Running Risk – Due to the public nature of blockchain transactions, DEX trades may be attempted by arbitrageurs or Maximum Extractable Value (MEV) bots attempting to extract value from unwitting users. Like high-frequency traders in traditional markets, these bots attempt to exploit market inefficiencies by paying high transaction fees and optimizing network latency to exploit regular users' DEX trades.

Centralization Risk – Although it aims to maximize decentralization and censorship resistance, points of centralization still exist. The DEX's matching engine is hosted on central servers, the development team has administrative access to the DEX's smart contracts, and includes, but is not limited to, the low-level token bridging infrastructure.

Network Risk – Because the transfer of assets is facilitated by blockchain, using a DEX can be very expensive or downright impossible if the network is congested or underpowered, leaving DEX users vulnerable to market manipulation.

Token Risk – Since many DEX feature permissionless market making – the ability for anyone to make a market for any token – the risk of buying secondary or corrupted tokens can be higher than on centralized exchanges. Users should consider the risks associated with participating in early-stage projects.

Dex Exchange can use Chainlink to increase security and unlock advanced features

Dex Exchange can leverage ChainLink Oracle Services to increase the flexibility of their protocols and introduce advanced features that users may be familiar with in a centralized infrastructure.

ChainLink provides accurate, secure, and reliable financial market data on price feeds, cryptocurrencies, commodities, forex, indices, and more, helping to secure billions of dollars for DeFi applications in multi-chain ecosystems. By leveraging the Chainlink decentralized Oracle network, dApps can receive off-chain price data and take action based on that data in a simple, secure, and decentralized manner.

The protocols can use chainlink price feeds for reliable price conversions, forward accurate price display, or secure calculation of rewards and fee distributions to shareholders. For DEXs linked to margin or futures contracts, price feeds can ensure the correct pricing of collateralized assets and an accurate liquidation process.

Chainlink price feeds can be used as an additional backstop by DEXs that want to increase their protocol's resilience to unusual market events, providing a battle-tested source of price data to aid resilience.

A secure price infrastructure will help ensure the safety and accuracy of the price monitoring and financial analysis infrastructure and help develop and manage arbitrage strategies between different decentralized exchanges. Chainlink Automation, a decentralized automation solution, is also widely used in the DeFi ecosystem to adopt advanced features through end-to-end smart contract automation.

Chainlink automation leverages decentralized, trustless off-chain computation to monitor user-defined conditions and trigger on-chain actions when those conditions are met. Chainlink Automation can trigger limit orders when asset prices exceed a predetermined price point.

This allows traders more granular control over their portfolio and saves development teams time and resources that they can invest in improving the business logic used to build their protocol core. With Chainlink automation, regular distribution of trading fees and staking rewards can be implemented reliably.

Frequently Asked Questions

Q. What cryptocurrencies can I trade on Dex Exchange?

Dex Exchange supports many major cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more. It also offers various new digital assets to diversify your trading options.

Q. What are the commission rates on Dex Exchange?

Dex Exchange offers very low commission rates compared to many other trading platforms. Exact tariffs may vary depending on the type and volume of trade. So detailed information can be found in the fee structure of the platform.

Q. Can I exchange cryptocurrency for fiat currency on Dex Exchange?

Yes, Dex Exchange allows you to exchange cryptocurrencies into major world currencies (fiat currencies) like USD, Euro, and GBP, giving you flexibility in your trading and investment strategy.

Q. How secure is Dex Exchange?

Dex Exchange places a strong emphasis on security, using advanced technologies and protocols to protect user data and digital assets. The Platform uses encryption, two-factor authentication, and other security measures to protect your account and transactions.

Q. What types of orders can I place on the Dex Exchange?

The Dex Exchange supports a variety of order types including market orders, limit orders, stop orders, and more. These options will help you shape your trading strategy and manage your positions effectively.

Conclusion

Dex Exchange APK is the cornerstone of the cryptocurrency ecosystem, allowing users to exchange digital assets peer-to-peer without the need for intermediaries. In recent years it has seen increasing adoption due to the instant liquidity it offers with newly launched tokens, the seamless onboarding experience, and the democratized access to trading and liquidity provisions it offers.