Numida Business Loan APK is a free Android application developed by Numida Tech that provides fast and convenient business loans to small businesses in Uganda. The app allows users to apply for a loan with no down payment and receive payments via Mobile Money within 72 hours.

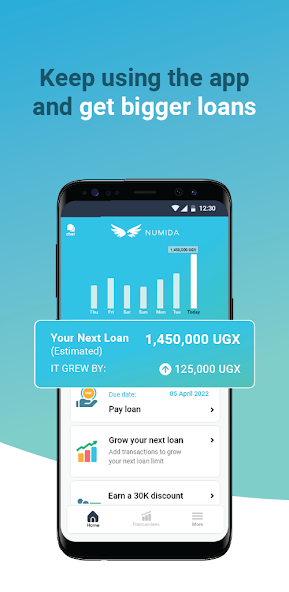

One of Numida's best features is its ease of use. Users can increase their credit limit and get even bigger loans to grow their business simply by using the app. In addition, the app provides financial information about the company by entering records.

It is important to always install the latest version of Numida to access the latest features. The app takes privacy and data seriously and uses the same security measures as banks to protect user information. Numida is a new loan app that offers personal loans to people in Uganda. Users can get loans up to UGX 1,500,000 if they meet all user requirements.

About Numida Business Loan APK

Numida Business Loan APK Small and medium-sized enterprises (SMEs) play an important role in driving economic growth and creating employment opportunities. However, financing their businesses is a major challenge, especially in developing countries.

This is where Numida comes into play with its innovative business lending solution that leverages technology to provide affordable financing to SMEs. Access to finance is a major challenge for SMEs in Africa. According to the International Finance Corporation (IFC)

The SME financing gap in sub-Saharan Africa is estimated at $331 billion, with only 19% of SMEs having access to credit from formal financial institutions. This funding gap is due to many factors, including insufficient collateral, high interest rates, and poor creditworthiness.

Numida is a digital lending platform that aims to address these challenges by providing affordable and accessible financing to SMEs in Africa. With its innovative lending products, Numida is changing the financing landscape for SMEs, enabling them to scale and grow their business.

It is a lending product from Ugandan fintech company Numida Technologies that leverages technology to provide affordable financing to SMEs. Numida business loans are tailored to the financing needs of small and medium-sized businesses, providing access to working capital, inventory financing, and asset purchases.

Features of Numida Business Loan APK

Loan Amount: It offers loans from UGX 500,000 to UGX 30,000,000.

Repayment Period: The repayment period of the Numida business loan is 3 to 12 months, depending on the loan amount and cash flow of the business.

Interest Rate: The interest rate for Numida business loans ranges from 10% to 15%, depending on the creditworthiness of the business.

Collateral: Numida business loans do not require collateral and are therefore accessible to businesses that do not have sufficient collateral to secure a traditional bank loan.

Processing Time: Numida Business Loan Apk has a fast and efficient loan processing system. Your loan will be approved within 24 hours of your request.

Loan Disbursement: Numida Business Loan disburses funds directly to the company's mobile money account, providing easy access to funds.

Convenient Financing: It offers competitive interest rates, making it more convenient than traditional bank loans.

Affordable financing: The app requires no collateral, making it easier for SMEs to access financing even if they don't have the resources to secure a traditional bank loan.

Fast Loan Processing: Numida Business Loans has a fast and efficient loan processing system where loans are approved within 24 hours of application, helping SMEs access funds quickly.

Flexible repayment terms: It offers flexible repayment terms ranging from 3 to 12 months depending on the company's cash flow, allowing SMEs to repay the loan at their convenience.

Improved creditworthiness: Timely repayment of Numida business loans can improve SMEs' creditworthiness and help them obtain more affordable financing in the future.

Ongoing commitment to data protection:

Bank-Grade Security: We use the same stringent security measures that major financial institutions use to protect your sensitive information. This includes encryption, secure data storage, and strict access controls.

Transparency is key: We believe in clear and open communication. Our Privacy Policy explains how we collect, use, and protect your information and enables you to make informed decisions.

Your data, your choice: You control your information. We provide tools and resources to help you easily access, manage, and update your data to ensure it remains accurate and reflects your needs.

Beyond Security: Building Trust:

Data Minimisation: We only collect the necessary information to process your loan request and provide exceptional service. We avoid collecting unnecessary data and thus reduce potential vulnerabilities.

Regular Audits and Assessments: We continually evaluate and strengthen our security practices through independent audits and penetration tests. This ensures we stay one step ahead of new threats and provide impeccable security.

Dedicated Support: Our friendly and knowledgeable customer support team is always available to answer your questions and resolve any issues related to the privacy of your data.

Numida: Your Trusted Financial Partner:

When you choose the Numida Business Loan APK, you are choosing a partner who puts your security and privacy first. Our goal is not just to provide fast and affordable business loans; We strive to build lasting relationships based on trust and transparency.

Focus on growing your business: When you know your data is secure, you can confidently invest time and energy in what matters most: the success of your business.

Make informed decisions: Our transparent approach allows you to understand how your data is used and make decisions based on your comfort level. Enjoy the peace of mind knowing your financial information is protected by industry-leading security measures.

Download the Kosh Loan App (Microfinance App) for Android for free. Become a Numida partner today and unlock the full potential of your business with the confidence that your data is safe.

Numida Business Loan APK log-in:

- Connecting to your Numida loan request is very easy

- After downloading the Numida Business Loan APK

- Click to open Numida Loan App

- Enter your username or phone number

- Then follow the password you used when registering

- Then press the Enter or the log-in button

Steps to request a loan on Numida:

- 1. Register

- 2. Enter basic details

- 3. Apply for a loan

- 4. Wait for approval

To get a loan from Numida, you need:

- 1. Citizen of Uganda

- 2. Between 18 and 65 years of age

- 3. Source of regular income

Conclusion

Overall, the Numida Business Loan APK is a great option for business owners looking for a simple and hassle-free digital loan solution. The recent improvements have further enhanced its reliability and user-friendliness, especially for users who rely on quick access to financing.