Paisayaar APK is a free credit checking app available for iOS. This app is developed by EWIN Marketing Consulting Pvt Ltd and is categorized under the Business Productivity category, especially Finance. With this app, you can easily check your credit score with multiple credit bureaus including CIBIL for free. Additionally, you can easily monitor your credit score by getting free monthly credit report updates for life.

Paisayaar provides detailed credit reports that can help you understand and improve your credit score. You can also read and download your credit report in Hindi, Marathi, Gujarati, Telugu, Kannada, and other regional languages. The app also displays your chances of being approved for loan and credit card offers based on your eligibility. Additionally, the app offers an EMI calculator to help you plan your loan better.

It has earned the trust and goodwill of nearly 25 million customers in the last seven years. Download Paisayaar APK now to maintain a healthy balance. The app can be contacted via a toll-free number, WhatsApp, and email.

.jpg)

About Paisayaar APK

Paisayaar APK is designed to be your preferred solution for managing your financial health and accessing multiple loan options. The app allows you to monitor your credit score. The updated reports are available free of charge every month. It contains detailed credit reports in multiple regional languages, ensuring accessibility to various user groups across India.

Users benefit from choosing from a wide range of financial products offered by over 60 partner institutions, including leading banks and NBFCs, depending on their lifestyle, needs, and eligibility criteria. With over 35 credit card options and instant microloans ranging from ₹1,000 to ₹50,000, it covers immediate cash needs and personal financial goals.

After browsing, users can easily compare, select, and apply for the most suitable loan or card. Offers pre-approved quotes to ensure minimal paperwork and fast delivery. In addition, personal expert help is available to guide people through the final stages.

A wide range of loan products are offered for both personal and business use, including competitive mortgage rates and options for those looking to transfer existing loans. Entrepreneurs can explore various offers to expand their business while existing borrowers can benefit from home loan options. Paisayaar App promises to be a lifelong financial partner to its users and provides a range of free loan and advisory products.

Because creditworthiness is important, this platform is an essential tool for those who want to maintain or improve their creditworthiness and easily access financial services digitally directly from major banks and financial institutions.

Features of Paisayaar APK

Paisayaar APK allows you to check your credit score from CIBIL and other credit reporting agencies for free. Plus, you can easily monitor your credit score with free, monthly updates to your credit report for life.

What you get with Paisayaar APK:

- Free credit reports from multiple credit reporting agencies including CIBIL

- Credit report updated every month with your new credit score - free for life

- Detailed credit reports to help you understand and improve your credit score

- Read and download credit reports in regional languages like Hindi, Marathi, Gujarati, Telugu, Kannada etc.

- View your approval chances for loan and credit card offers sorted by your eligibility.

- EMI calculator for better planning of your loan

Paisayaar APK has earned the trust and goodwill of nearly 25 million customers in the last 7 years. Download the App now to maintain a healthy balance.

Highlights of Paisayaar APK

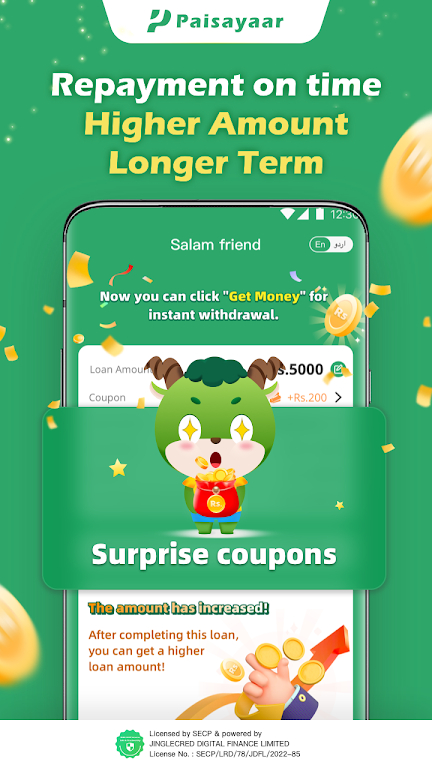

Paisayaar APK is an excellent financial services platform registered in Pakistan. NBFC License Authorized by SECP. Providing fast, flexible, and secure loan services to Pakistani citizens. Users can use their mobile phones anytime, anywhere to pay Rs. Can apply for personal loans up to 25,000.

The details of the loan are as follows.

- 1. Loan period: 60 to 90 days

- 2. Loan Amount: Rs. 1,000 to Rs. 25,000

- 3. Maximum Annual Billing Rate (APR): 2% to 12% per year

For example:

- 12,000 for 3 months is calculated as follows:

- Monthly growth rate: 12%/12 = 1%

- Total Surcharge: Rs 12,000*12%/12*3 = Rs 360

- Total refund amount: Rs. 12,000 + Rs. 12,000 360 = Rs. 12,360

- Amount payable monthly: Rs 12,360/3 = Rs 4,120

Product advantages

- 1. NO LIMITATIONS, AND NO WARRANTIES IF YOU ARE 18 AND OLDER.

- 2. You don't have to wait long.

- 3. Check online 24 hours a day.

- 4. Information security, multiple privacy protections to prevent disclosure.

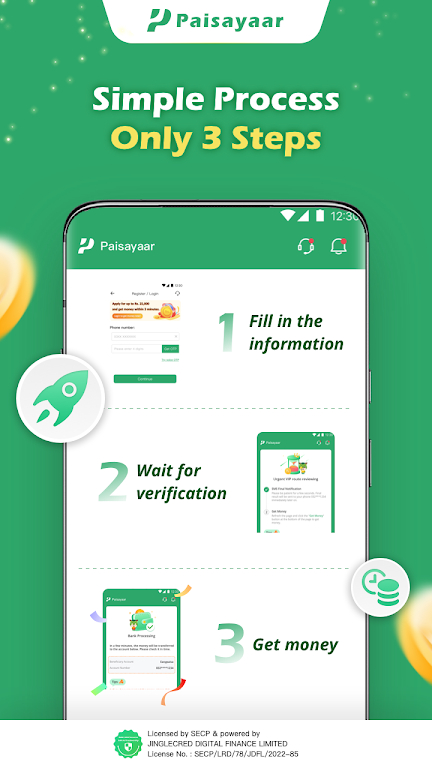

How do I get a loan?

- 1. Download Paisayar on your phone from the Google Play Store.

- 2. Register with your mobile number.

- 3. Enter your personal information, take a clear photo, and submit your application.

- 4. Wait for approval and delivery begins.

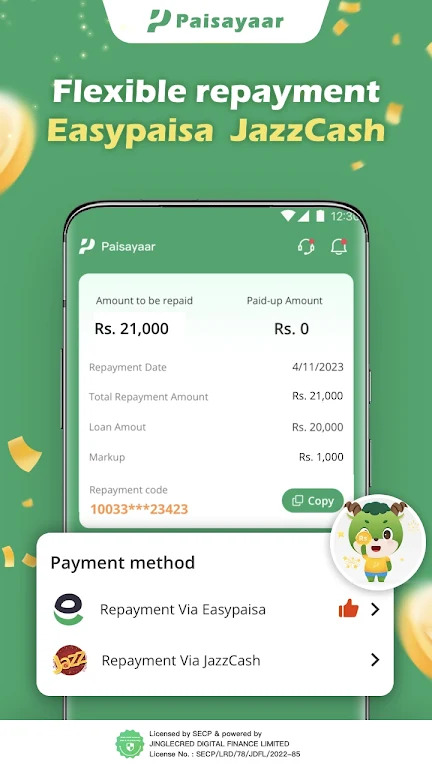

How to pay?

- Refund via Easypaisa. There are three different ways to repay a loan with Easypaisa:

- EasyPaisa application, EasyPaisa USSD

[Protection of personal data]

We have successfully passed the Securities and Exchange Commission of Pakistan (SECP) examination and received the relevant credit qualification. We ensure the security of your data and provide reliable credit services.

At Paisayaar APK, the security of your data is of utmost importance to us. We have strict data protection and verification procedures and will never share your information with third parties without your consent. This Privacy Agreement may be changed from time to time.

If you have any questions about our privacy policy, you can contact us via customer service phone number, email, etc. We have a professional customer service team to answer your questions. You are responsible for understanding and reading this Agreement. If you have any questions, please send your feedback to our official email address ([email protected]).

Conclusion

When it comes to getting an instant loan at the lowest interest rate in a short time. In this regard, we recommend that Indian mobile users download Paisayaar APK Android here using the one-click option. Then install it on any compatible smartphone and enjoy professional online lending features.

About Author

Ritu Raj is a professional content creator specializing in technology-related topics. With three years of experience, she has honed her skills in conceptualizing, creating, and managing content for various online publishing firms.

Currently working at Apkresult, Ritu focuses on producing high-quality and easily understandable content covering various subjects such as Windows OS, Android, iOS, social media, cloud computing, and other general consumer technology topics. Her expertise lies in simplifying complex technical concepts for a broader audience, making her content accessible and informative. Contact Me on Linkedin.